This forgives new decreased of a beneficial borrower’s education loan balance or an appartment dollars number, instance $ten,100000, $twenty five,000, $fifty,000, or some other amount. It could also require waiving one called for taxes with the forgiven number. Doing this will bring a great common benefit one assures mortgage obligations will end up being totally cleaned aside getting borrowers with an equilibrium lower than the desired height, when you find yourself those with higher costs buy some save.

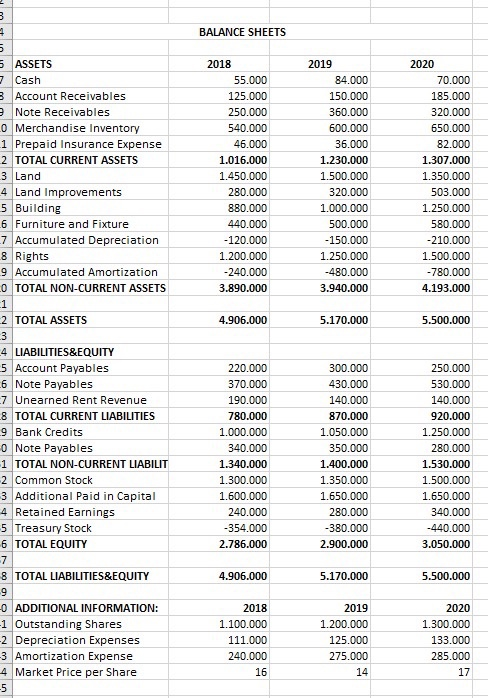

Dining table 2 breaks down the newest part of consumers in a given racial/ethnic group depending brand new collective level of federal funds borrowed

Projected costs: The full rates may differ according to dollar height selected. Eg, forgiveness all the way to $forty,100000 for everybody borrowers carry out cause canceling $901.dos million, whenever you are forgiveness of up to $ten,one hundred thousand do terminate $370.5 mil. Each other instances could have extra can cost you in the form of asked upcoming desire costs, but it’s difficult in order to calculate accurately this count that have newest Education Department study. In the end, there is costs associated with perhaps not taxing forgiven wide variety https://paydayloanadvance.net/payday-loans-nh/.

Estimated outcomes: Consequences are different because of the dollar amount selected. Forgiveness all the way to $ten,000 would eradicate all of the education loan obligations to have an estimated sixteen.step three mil consumers, otherwise 36 % of all of the borrowers, and relieve from the 50 % of stability for another nine.step three billion, otherwise 20% of all the borrowers. 31 Forgiveness all the way to $40,one hundred thousand would eliminate debt to have thirty-five billion consumers-regarding the 77 per cent from individuals. The number of consumers who would have got all its obligations terminated not as much as this plan would be a bit lower, according to buck amount, because the people exactly who currently seem to have reasonable personal debt profile come into college and are usually therefore gonna have high loan stability as they keep their studies. Dining table step one suggests the brand new estimated consequences and you may will cost you across the a selection from restrict forgiveness wide variety.

Considerations

Will it address security? Yes, though the exact equity implications are different a bit in line with the top chose. Desk 3 flips that it study to demonstrate the fresh shipments away from expenses inside confirmed racial or cultural classification. One another dining tables are derived from consumers exactly who joined higher education for the the 2003-04 educational seasons as well as their cumulative government financing numbers in this twelve years. While this is an informed picture of longitudinal student loan circumstances because of the race and you can ethnicity, the fact that such figures show students who earliest signed up prior for the Higher Recession setting it’s possible you to, was indeed they offered, latest number might reveal more results. From inside the given this type of tables, you will need to recognize that high amounts of forgiveness would however give advantages for everyone from the lower levels out-of loans also. Which means increasing forgiveness in no way leaves people with lower balance bad from.

Latina or Latino individuals, such as, usually disproportionately make the most of a good forgiveness policy that picks a smaller dollar amount, that category is the reason a keen outsize display off individuals with $20,100000 or smaller during the pupil financial obligation. thirty two These types of same anybody create nevertheless make the most of forgiveness within highest dollars quantity, however their concentration certainly lower-balance consumers form the newest ounts try reduced.

The story varies to own black colored or African american individuals. They generate up a roughly proportional display from reasonable-harmony borrowers but good disproportionate express of these just who took away ranging from $forty,100000 and you may $a hundred,one hundred thousand. 33 That implies the fresh new erican consumers will be better to have highest money amounts.

Deciding on individuals considering Pell Give receipt says to a slightly various other facts. Anyone who has received a good Pell Grant is proportionately illustrated certainly lower-harmony borrowers and you can underrepresented one particular with the highest balances. But they are extremely overrepresented one particular exactly who took out between $20,100000 and you can $60,100000. 34